My presentation on Liquid Staking from the GCC x Ethereum Foundation meetup, in May 2021.

eth2: the story so far

Presentation from the GCC meetup in March 2021. Here’s the recording for those of you that speak the mother-tongue.

Eth2 Medalla: a journey through the underbelly of eth2's final call before takeoff

🌈✨ eth2data.github.io ✨🌈

A new equilibrium on Ethereum

Gas costs on Ethereum are on the up an up. Not the first time it happens. However, it's the first time that this is coupled with an explosion of present utility value on the platform.

Could this lead us into a new gas cost equilibrium, and what does it mean for the ecosystem?

To answer this question, it’s useful to first align on the context around past periods of high gas cost and network congestion, since Jan 2018.

The priors

In that time frame, there are 3 notable events, namely: (i) the CryptoKitties launch (ii) FCoin’s trans fee mining and (iii) Fairwin.

Source: glassnode.com

What these periods/events have in common is that high gas prices were driven by one entity at a time. The attention, engagement and useage these entities commanded inflated and then deflated fairly quickly. This time, however, things look different.

Fast forward to summer 2020

Contrary to those times, the present condition finds us with (i) several interconnected yet distinct from one another projects/contracts, (ii) a whole lot more stablecoin on Ethereum - which in turn multiplies the economic utility a user can extract from the ecosystem and (iii) more users than ever.

Total DeFi users (cumulative) - Richard Chen

As a result, it’s not a far cry to assume that the current high gas price and network congestion state will persist for much longer than it has in the past. There is no single Ponzi that will eventually collapse, or any other type of attention suck that will eventually totally and irrevocably implode. If we take that operating assumption to be true, then what should we expect for the future of DeFi on Ethereum?

Ethereum on a new gas equilibrium

At this point it’s useful to define the shape of the relationship between the demand for and supply of resource bandwidth on Ethereum.

A way to think about the current state of the platform, is that we are moving from one equilibrium where users accessed limited utility to another where users access enhanced utility. As demand for access grows together with added functionality, user tolerance for higher gas fees increases as their available surplus expands.

It is also reasonable to assume that the supply curve here is an exponential function that approaches perfect inelasticity as the platform output limit is reached (e.g. block space). At this point the surplus available to users (consumers and protocol/app publishers) is capped, and if demand persists, price tends to infinity, supplier/miner surplus skyrockets yet output remains capped.

Naturally, given that existing on Ethereum as an economic agent is not (yet) a necessity for most, users will start dropping off at the point where the cost of operating (gas) starts eating into user surplus. This is more true for consumers than it is for publishers - which likely have a higher pain threshold.

A house of cards

Now, there are several open questions here - namely: (i) have contract designers, architects and operators planned for a new equilibrium on Ethereum? (ii) If this is indeed a new equilibrium re: gas cost and overall activity on the network, how much room do current contract operators have to wiggle? (iii) How ready are L2's (and horizontal standards thereof) for primetime?

If the present trajectory holds and the assumptions above are true, then we will inevitably reach a point where output remains stable as we will be at max capacity (perfectly inelastic part of the supply curve above), but prices will keep rising. At some point price will be so high that it starts eating into user surplus. Users (in this case both consumers and protocol publishers) will likely start dropping off and the Ethereum economy will return to a lower equilibrium. It will first be the minnows and then the dolphins, leaving sharks and whales operating - albeit at margin compression, as the providers of the yield (minnows) will have been priced out at that point.

The way forward

Since Ethereum 2.0 won't be functional for the forseeable future, here's some ways in which we might end up avoiding the condition described above: (i) users will tolerate ever growing fees and network slowdown (unlikely), (ii) app builders and users move onto Ethereum killers, and (iii) Ethereum Layer 2 gets activated in a big way.

Option (iii) looks like the path of least resistance at the moment - but tread lightly, as this space if still fraught with a lack of standardisation that might make reconciliation of transactions across different L2 approaches a complex endeavour (to the extent that it might make L2 scaling unusable at scale for - at least - the short term).

Bitcoin bubbles; the optimal distribution mechanism

Why planned fair distributions don't work for broad use cases - adapted from an internal memo drafted in May 2019.

Bitcoin’s volatility profile is - by now - the stuff of legends. Monumental, euphoric rallies give way to abrupt, violent crashes and proclamations of Bitcoin’s demise (380 and counting). Thus far, the cycle has repeated without failure, earning Bitcoin the “Honey Badger” moniker in the process.

As the current cycle is unfolding, behind the BTC/USD pair’s most recent gyrations, new types of participants are entering the market; traditional macro money managers (e.g. PTJ) and nation states (e.g. Iran) are becoming increasingly open about dipping their toes in the cryptoasset ecosystem.

With every new type of player that jumps on board, the likelihood of Bitcoin becoming a widely accepted store of value and the Bitcoin blockchain becoming a globally accepted settlement layer, increases. The “why” Bitcoin makes for a good settlement layer and store of value has been covered extensively. However, the “how we get there” remains somewhat elusive. In this post, I will attempt to unpack that.

Fair != Equal

Let's for a moment imagine what an optimal state of the Bitcoin network at maturity looks like; Bitcoin is a widely accepted global store of value and/or settlement layer; global institutions (e.g. central banks) are on board, co-existing with crypto-native actors (e.g. miners); market manipulation is too expensive to attempt, as are direct attacks on the network; BTC is distributed widely among holders, such that network participants extract maximum value by being able to settle with all other parties they may wish to, and that no party has disproportionate “bargaining power” over network outcomes, allowing participants in the network to be continuously incentivized to remain participants.

From the above, a “fair” allocation of BTC among holders seems to be a key underlying requirement for this future to come to bear. Note that “fair” is not the same as “equal”.

Fairness, in this case, implies that every participant’s utility function is maximized, subject to their unique constraints. Under that condition, “equal” is “unfair” and therefore, unsustainable.

If we assume the “fairness” condition as requisite, then while not necessarily an easy pill to swallow, the rollercoaster ride might be the *only* path available to get us there. To illustrate the point, an approach by deduction reveals why the competing approaches cannot work;

A centrally planned diffusion mechanism: this construct fails as the planner holds all the bargaining power - such that no other party would willingly opt-in. In order to be executed effectively, it would have to be orchestrated and delivered by a benevolent dictator (a party with perfect information and perfectly benign incentives), and for all participants in the network to trust that the allocator is indeed benevolent. In practice, impossible.

A diffusion mechanism planned by a “political” coalition: this can’t be orchestrated in a multi-party explicit negotiation format, because there are too many conflicting interests at play in order to implement top down consensus. If it is sufficiently hard to achieve with structures where there is some cultural cohesion (e.g. EU and the Eurozone), it should be near impossible to achieve at a global scale.

Economic bubbles as a by-product of fairness

So if we agree that neither of the two are viable options, the only option left is a free market mechanism; a continuous game, that is played by individualistic agents with hidden preferences, in near infinite (and infinitesimal) rounds, that allows for each participant to opt-in at the valuation that perfectly satisfies their objective function (what they strive to maximize under given constraints), therefore covering the full utility spectrum of the population of agents.

Hidden preferences become revealed ex-post and as such competing agents cannot devise a strategy that creates a surplus for themselves that leaves others at a deficit ex-ante, resulting to an ultimately fair distribution. And in the process of revealing preferences in a continuous game with infinite rounds, bubbles are created. Competing agents with similar objective functions are forced to respond to the first mover among their counterparts and jump on the bandwagon. Under scarcity, the price rallies, until the reservation price of agents that opted-in earlier is met. At that point the distribution phase begins, as earlier participants divest and get rewarded for stewarding the network thus far, by locking in a margin. As painful as the process might be, it ultimately yields to a fairer allocation.

As the "rounds" of the tacit negotiation - come free-market-bonanza - game unravel, the very nature of the platform evolves, opening up to a wider possible utility spectrum. With time, the network becomes more secure as wider margins become available for miners (either through higher prices or through advances in operational efficiency) and more resources are committed towards Bitcoin’s Proof of Work. It follows that as the network’s security improves, it opens up to new types of agents that are striving to maximize value preservation potential, subject to the liability they have to their constituents (measured as risk). The more types of agents there are on the network, the better a settlement layer it becomes, and so on.

Therefore, there is sense to the idea that progressively larger agents would opt-in at a higher prices, as they are effectively buying into a fundamentally different - and arguably better - network for value store and transfer. And with every new type of agent unlocked, the bandwagon effect re-emerges.

Conclusion

Bitcoin might not have been a secure or wide enough network for Square (an agent to its shareholders) to consider as its future payment rails and settlement layer in 2015. It is in 2020. Similarly, while Bitcoin might not be a secure or wide enough network for a sovereign to opt-in in 2020, it might be in 2025.

So, not only should we not be surprised by the new type of participant that is emerging in the early innings of this cycle, but we should expect more of this as the network’s value increases and its security profile improves.

And in the process, we should learn to accept the nature of the game.

PoW mining: the role of producers in Bitcoin’s market structure

Presentation from the Greek Cryptocurrency community meetup on the 25th of April 2020.

Recording from the MIT Bitcoin expo 2020

In early March 2020, Tara and I presented the collaborative State of Adoption report at the Bitcoin MIT Expo. As Covid-19 was starting to spread fast in the West, we opted for zooming in rather than attending in person - a decision we made only a week before the event. As things unfolded, more than half of the presenters and panelists ended up tele-participating.

Read MoreCovid-19 and the big unwind

Monday 5pm GMT: Since March 9th, financial markets are going through one of the fastest downturns in recorded history, as western economies scramble to battle the spread of Covid-19.

The macro view

On Sunday (16/03) the Fed announced a round of emergency rate cuts, down to a target of 0% to 0.25%, along with $700 billion worth of asset purchases, that include Treasuries and mortgage-backed securities.

Global markets had none of it; the Dow is down ~9%, the FTSE 100 is down more than 10% on the opening, while Asian markets are hit less hard, though still down to the tune of ~4% - the MSCI Asia Pacific Index was down 3.8% at the opening. As global economies go in lockdown mode, the appetite for risk has vanished, pushing bonds and all the USD forex pairs higher as capital finds its way to safety.

Mayhem in crypto

This past week was also the worst week for crypto since at least 2013. Amidst the global flight to safety, Bitcoin has also lost its uncorrelated status, and is moving in tandem with traditional markets, almost tick for tick. The drawdown in crypto was accelerated as highly leveraged positions on Bitmex started getting margin called, putting a liquidation cascade in motion. Since then, liquidity seems to have evaporated, as order books across most exchanges are much thiner than usual and open interest in futures is in multi-year lows.

In all, we are now deep in bear country. Rallies are being sold aggressively, and as if everything else happening wasn't enough, with the halving coming up Bitcoin will see an additional set of natural sellers emerge; unprofitable miners. As the block rewards get cut in half, the effective cost of producing bitcoin will double. Reports have it that S19 and S15 miners are already shutting down, and that the greater mining community is in panic mode. As the BTC/USD pair edges closer to the $4k level, increasingly more miners will be shutting down and selling BTC to cover costs. Those with cash will survive this. Those without will be exiting. And as they do, prices will slide.

Bitcoin—still a risk asset

The week of March 9th 2020 was a strong test for cryptoassets; one which they failed to pass with flying colours. The narrative that Bitcoin is a store of value has been dispelled - at least for the time being. While it has the properties of one, this week put the debate about its current status beyond any reasonable doubt. Bitcoin is - still - a risk-asset, as are the rest 4,000+ cryptoassets in the investable universe. It will take some time before the global sentiment for risk returns. But, eventually, it will.

While sentiment and prices change, fundamental properties do not. As this downturn exposed the chronic pains that underlie cryptoassets (e.g. scalability, oracles, fragmented markets), I believe that over a longer time horizon this will be remembered as a pivotal point that served as a wake-up call for builders, investors and pundits alike - to ground expectations and re-focus attention on what really matters in order to bring this technology to a massive global audience.

It’s always darkest before dawn

From an investment standpoint, the weaknesses that were exposed over the past week represent investable opportunities. There are strong teams with ample runway that are working on solutions to the industry’s endemic problems, and cryptoassets that are economically tied to the success of those solutions. Many of these cryptoassets also happen to be priced a lot more favourably than they were just a week ago.

Over the coming weeks, it is highly likely that the pricing of these opportunities will become even more attractive.

As the global economy moves towards a recession and with interest rates being already at - or close - to 0, deflation will kick in. But then, as the effect of the coronavirus wears off, confidence will return. People will start spending again, interest rates will rise, and with all the liquidity sloshing around, eventually inflation will kick in.

Bitcoin was never a hedge on a global emergency. It does though have the fundamental properties of an asset that can be a hedge on the debasement of fiat currency. And as growth - and with it inflation - returns and with the money printer already firing on all cylinders, Bitcoin will get its ultimate test. And I believe it will succeed.

But even if it doesn’t - it’s not the only game in town. We’re talking about retooling the financial system here. You surely can’t do that with a hammer alone.

I’m not a maximalist, but If I am anything in the “-ist” contingent, is an optimist. As an optimist - not a deluded one, I remain optimistic about the future of the asset class.

It’s always darkest before dawn.

State of Adoption 2019/2020

Access the full presentation at stateofcrypto.report

In Jan 2019, while at The Graph Day 2019 in SF, I caught Tara Tan’s presentation on designing for users in crypto. I immediately thought it was powerful.

A combination of data that lay the problem bare (e.g. 42 or so user steps to use Maker DAO) and allegories that made the subject relatable (e.g. the bicycle being a fringe technology until it became user friendly - read: dominant design) carried an important message through; crypto needs design. But perhaps more important than the message, was the delivery - which proves the message’s point in this case!

Intrigued, a few months later, I got in touch: “hey - loved your presentation at The Graph Day, let’s connect and see if there’s common ground we can work on together”. Fast forward to June 2019 we had a plan to draw up a report on the state of adoption in crypto. We quickly realised that in order to create something impactful, but also true to the facts and thin in bias, we would need help.

Enter the State of Adoption 2019/2020: a collaborative report on the state of things in crypto, pulling data and insights from world class operators (e.g. Bison Trails, River Financial), investors (e.g IDEOVC, Outlier Ventures), data co’s (e.g. Token Analyst, Dune Analytics), native to the cryptoasset ecosystem.

With this piece of work, we aim to align investors and entrepreneurs already active in the space, but also intrigue and inspire those that are curious, with respect to where we are at, where the opportunities lie, and what it will take to bring us to the new paradigm.

Cryptoassets in transition

Taken from Decentral Park’s Annual Investor Letter for 2019

2019 has been quite a ride for global markets. The year started with a rallying S&P and confident markets which quickly transitioned into fear, uncertainty and doubt, as the Sino-American trade war took center stage and the yield curve inverted for the first time since 2008, summoning fears of an impending recession. In that environment, cryptoassets had a mercurial H1 2019, coming off of a brutal bear market in 2018.

Emerging cryptoassets within the cluster outperformed the average in Q1, passing the baton to Bitcoin in Q2, which led the way with a 230% appreciation, bottom-to-top, from April to July 2019. At the time, there were strong indications that the pent up demand for capital flight from China found a suitable vehicle in Bitcoin, as global economic uncertainty rose [1]. However, this did not sustain for long, leading the overall asset class to deflate by ~50% over the course of H2 2019.

Although Bitcoin failed to meet expectations set by the excitement garnered by 1H19’s run-up to $13k per BTC, the asset class overall is once again the best performing for the year, returning +90% beginning to end, whereas the NASDAQ returned +38%, the S&P +31% and REITs +27%.

Be that as it may, the sentiment among market participants - at present - is much bleaker than the absolute YoY performance implies, reminding us that biases are omnipresent in how sentiment manifests in markets. In this case, it is an anchoring bias, a recency bias and loss aversion in full effect [2].

As Bitcoin descended from July highs for most of 2H19, the trade war fears were dispelled and under the onlook of a dovish Fed, the Dow and the S&P both broke to new all-time highs. Considering the developments within the world of cryptoassets, we are - quite frankly - dumbfounded by the weak sentiment. While being cognizant and appreciative of the limitations of cryptoassets and the challenges that lie ahead, we cannot help but continue to be optimistic about the medium and long term prospects of the asset class.

2019: a year of quiet infrastructure development

Our thesis has always been that there are two forces that charge adoption prospects for cryptoassets; 1. top-down adoption by institutions and legacy finance, and 2. bottom-up adoption of Web 3.0 and Open Finance innovations and primitives by the general public. 2019 was a year of steady infrastructure development and deployment in both of these areas.

Top down

2019 saw a continuous stream of innovation in institutional infrastructure, with cornerstone products such as digital asset custody and derivatives being delivered and further developed from both legacy players such as Fidelity, ICE and the CME [3], as well as crypto native players such as Coinbase, BitGo and Binance [4]. These advances are bringing mature and trusted prime brokerage solutions closer to the cryptocurrency industry, and will enable the deployment of ever more complex strategies at scale, while simplifying the complexity at the base layer of this technology, head-on.

At the same time though, 2019 saw multiple rejections of applications for a Bitcoin ETF - and for good reason. The market is still fairly fragmented, small and immature for an ETF, with a prime example being the lack of a generally accepted and agreed upon true price of Bitcoin. Despite this, in December 2019 Charles Schwab reported that Grayscale’s Bitcoin Trust is the 4th most popular equity amongst Millenials in their customer base - more popular than Netflix or Berkshire Hathaway [5].

As progress in data pipelines is made and liquidity improves, the uncertainties around the asset class will become increasingly less, at which point we expect to see the development of products that will make Bitcoin’s inclusion into ISAs (Individual Savings Account) and IRAs (Individual Retirement Account), a matter of routine.

While we do not believe that this will become commonplace in 2020, we do believe we will see material progress in that direction, both in regulations, and in market structure/infrastructure.

Once that milestone is cleared, and the asset class has grown sufficiently to become even more generally accepted, the probability of it being included as an asset of pension funds and endowments increases dramatically. The most forward thinking of the largest allocators are already getting smart in and around the asset class, primarily via allocating to Venture Capital [7], while some have started dipping their toes in direct token purchases.

The last but perhaps most important piece of the puzzle for top down adoption is regulatory clarity - or, at present, lack thereof. Bitcoin’s Q2 ascent was accompanied by the announcement of Libra - Facebook’s blockchain-based stablecoin initiative, that would - upon launch - bring digital wallet infrastructure to Facebook’s massive user base.

Libra’s launch was soon put on hold by US lawmakers, with both Mark Zuckerberg and David Marcus (Libra CEO) having to undergo multiple rounds of hearings in front of the US Congress and Senate. The biggest result to so far come out of those hearings, was the lack of alignment among members of the House and Senate, which continues the uncertainty for entrepreneurs and managers in the space.

Meanwhile, in October, Xi Jinping publicly labeled blockchain an important strategic focus for China, causing a flurry of activity in the market [9]. Amongst the most notable events to follow, the Bundestag issued a decree enabling German banks to sell and custody crypto starting 2020, the ECB announcing a proof-of-concept for anonymous transactions using central bank backed digital currency, and more recently a draft bill entitled “Crypto-Currency Act of 2020” was introduced in the US House of Representatives.

Given the sense of urgency that China’s aggressive move seems to have instilled in its counterparts, we believe that 2020 is going to be a pivotal year for a much needed regulatory framework that will de-risk the emerging asset class.

Bottom-up

Even in the face of structural uncertainty, in 2019 the builders have been hard at work and their labour is already bearing fruit - with Ethereum (#2 public blockchain and #1 smart contract platform by market capitalization) the clear leader in attracting developer interest. Ethereum has been a hotbed for developer activity, with Open Finance (or DeFi) use cases finding notable traction.

There are now stable value issuers (e.g. Maker DAO), loan facilities (e.g. Compound), market makers and exchanges (e.g. Uniswap, Kyber) and derivatives facilities (e.g. Synthetix) that are fairly well established, while we are seeing use cases in insurance (e.g. Nexus Mutual), interfaces (e.g. Zerion), and payments (e.g. xDai) emerge.

These protocols and applications live purely on-chain, are largely software operated and have processed multiple hundreds of millions of USD in loans, payments and collateral value in 2019 [10].

Over the course of 2019, Ethereum became a lot more expressive. There are now more frameworks, IDEs and mature blocks of value within Ethereum that can be used as references for new applications, enabling developers to deploy a wider array of features, faster than ever before.

Given the product/market fit that the category is showing, Ethereum’s lead in developer mindshare and maturity of tooling, but also being cognizant of the platform’s scaling and governance limitations , we believe this to be the space where most value will be created and captured in the next 2-3 years.

It is indicative that in an indexing exercise exploring 2019 returns, DeFi has been the standout performer, primarily driven by the mercurial H2 performance of Synthetix (SNX) - a 30x run. Additionally, the money and finance related indices have strongly outperformed all other clusters in 2019 - a clear indication of where product/market fit can be found at present and how much it matters to the market.

Some of the areas that we are excited by within the cluster, are synthetic asset solutions that will reduce collateral ratio requirements, allow for legacy assets (e.g. equities) to be printed on chain and transacted at a fraction of the cost of traditional brokerages, enable new forms of hedging risk for crypto native businesses (e.g. hashrate derivatives) and - well - new forms of leverage. After all, given the early stage we are currently in, speculation largely remains the main use case.

Concurrently, in 2019 we saw glimpses of the rise of domain specific chains. Different fee structures for platform resources and performance limitations and trade-offs across different chains create breeding grounds for fundamentally different applications. As such, while Ethereum has found traction in use cases that are described by low friction and high transaction value, chains like EOS - and more recently WAX - are finding traction in high friction and low volume applications (e.g. games) [11].

While - in theory - Layer 2 solutions can allow for such applications to work on slower chains, it is hard to argue that these solutions will provide a more compelling alternative to chains that are purpose built to withstand heavier loads.

However, most of the aforementioned platforms are still in their infancy (e.g. WAX) and others are yet to launch (e.g. Telegram’s TON), as is the case with the interoperability bridges that will allow value to frictionlessly traverse through different blockchain ecosystems (e.g. Cosmos).

We see the next two years as the time when these platforms will prove (or disprove) their viability and pave the way for immense value creation from 2021 onwards.

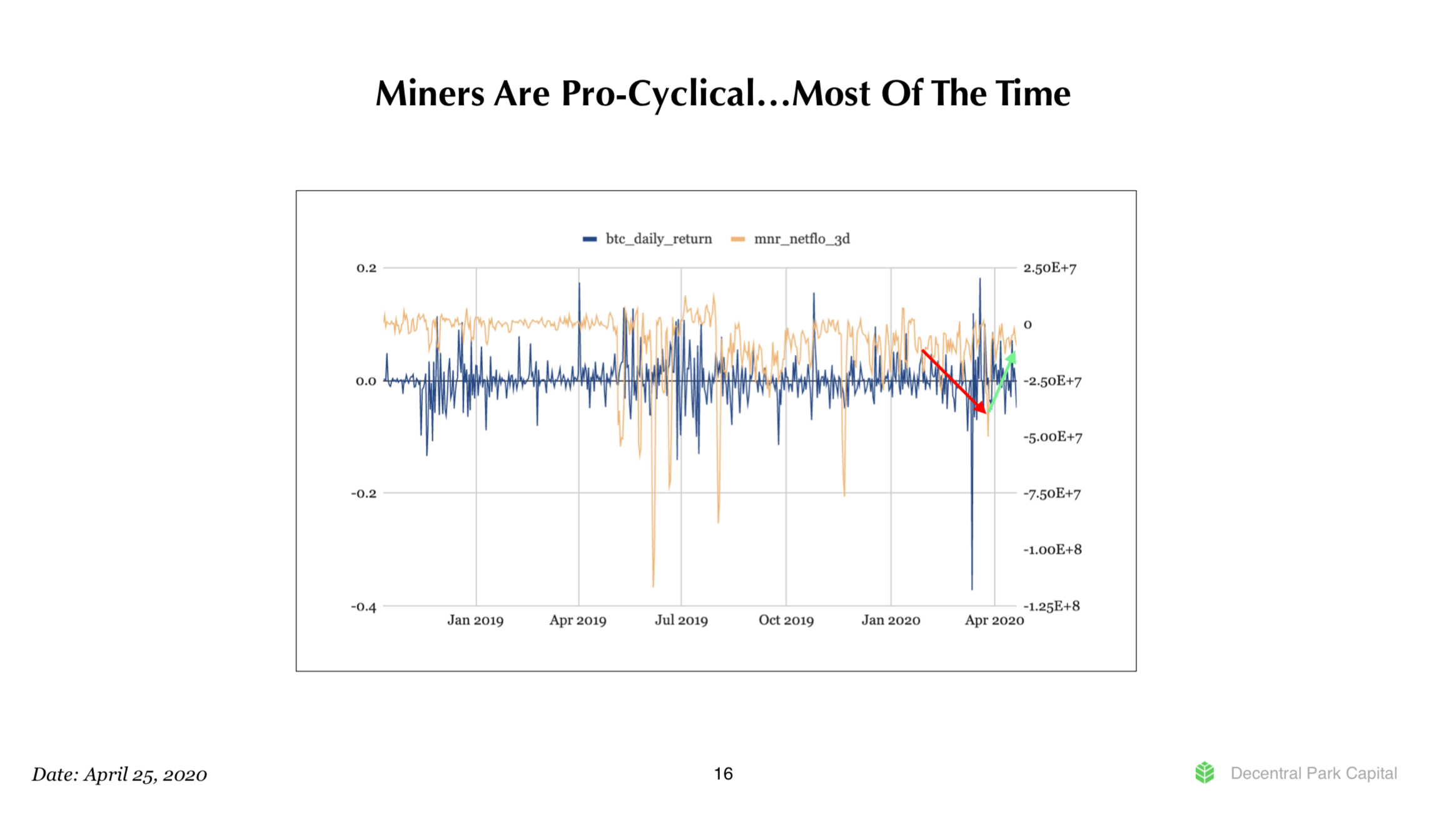

Miners are not capitulating (yet!)

A tweetstorm looking at on-chain flows in and out of tagged miner addresses, at a time when the crypto-twitterati were snowballing into the narrative that the recent price action was instigated by unprofitable (or close to being unprofitable) miners selling down on their BTC stock.

With all the talk on $BTC miner capitulation, it's a good time to look at what kind of story the data tells - with a little help from @thetokenanalyst.

— elias.eth (@eliasimos) November 20, 2019

A short thread 👇🏼

Art imitates life

Last night I made this quick game using Python. The rules are simple - you have to roll doubles to win prizes. The closer to 12 the sum of your doubles, the bigger the prize.

I guess I got lucky…

Beyond the hype on terra.money

Key Takeaways

There is a hidden negative multiplier effect in the Terra system, that will dampen the price of Luna - until a network effect is reached.

There is a hidden viral loop in the Token economics, that incentivizes merchants to also be stakers and enlist as many other merchants as possible to drive their unit costs down.

The interplay of the two loops optimizes for long-term oriented actors to populate the consensus layer, a net positive.

Both the decision to start with Korea, and the go-to-market strategy Terra is deploying, are moats in the making, if executed well.

Luna lost ~75% of its value since listing in Q3 2019. At current prices, pre-sale investors are likely at break-even, having already booked (some) profit.

Conservative estimates from a DCF model, show that Luna, at current price levels, is undervalued by between 38% and 67%.

Terra.money; seigniorage shares done right

Terra is a stablecoin project out of Korea that deploys a seigniorage shares model in order to algorithmically ensure stability in the system. This is not the first time we see an asset of this type hit the market - Basis and The Reserve are the two most prominent ones that jump to mind. However, where its predecessors have thus far failed, Terra is getting promising traction.

Terra's base layer token economics

Terra is essentially composed of 2 tokens that live in parallel; Terra and Luna. Terra(X) is the stablecoin component - where (X) is any fiat equivalence supported on Terra (e.g X = KRW, USD etc), and Luna is the protocol token. Terra powers the user facing part of the terra.money platform, while Luna - a fixed supply variable price token - powers the infrastructure.

The blockchain layer in Terra collapses the multiple layers of payments processors present in modern day e-commerce and P2P payments value chains, and manages to reduce the cost of executing transactions by as much as 80% - ledger fees start a default of 0.1% and are capped at 1%. Validators have to stake Luna in order to be granted the right to validate blocks and access a perpetual stream of ledger fees as a reward for their work - and equivalently are exposed to slashing if they are found to misreport ledger state. A validator's Luna stake represents pro-rata odds of generating Terra blocks; i.e. the more Luna you stake, the higher the expected value of the rewards you claim. Luna holders are also granted governance rights over the fiscal stimulus treasury - endowments to dApps that apply to the Terra ecosystem.

How Terra maintains stability

Terra maintains stability by algorithmically adjusting the money supply. In an excess demand condition, where Terra would go off its peg on the upside, the system mints more Terra and burns an equivalent (according to the spot exchange rate) amount of Luna. Conversely, when Terra is experiencing a lot of selling pressure, the system mints and auctions more Luna in order to buy back and burn Terra - contracting the money supply and diluting Luna holders.

A hidden negative multiplier effect in the stability mechanism

Herein lies the first issue with Terra's model; validator dilution. Until the stablecoin instrument has enough brand recognition, trust and ultimately network effect, so that the perceived risk of holding Terra on balance sheet is low, merchant incentives remain somewhat warped. Here's what I mean:

1 unit of TerraUSD on balance sheet is worth less than 1 unit of fiat USD, due to their differing counterparty risk profiles.

The former is backed by a consortium of private actors, while the latter is backed by the US government. Until a network effect enough strong enough to persuade merchants otherwise is in place, they are incentivised to offload that balance sheet risk and head for the nearest exit to government backed fiat.

The effect is continued dilution for Luna holders.

Similarly, in the pegging process described earlier - where equivalent values of Terra and Luna are arbitraged away to bring the peg to balance, in order for the arbitrageur to book profit, they need to immediately liquidate the Luna they receive in equivalence. If that incentive structure holds, then not only are validators diluted by inflation in the short term, but the value of their Luna holdings reduces further as market makers immediately offload the minted Luna to market, increasing the available supply of the asset. Absent a network effect, this dynamic acts as a negative (unintended) multiplier in the Terra system.

Compensating validators for dilution

To incentivise validators to weather the storm, Terra introduces long-term validator incentives in the form of inflationary rewards (currently ~10%). Effectively Terra is inviting potential validators to ride out the J-curve with them and collect beans in the process. At a high-level, the idea makes sense; the negative multiplier effect should hold only until the network effect is reached. Once that is achieved, then the loop should turn from adverse to virtuous, and value would start to trickle back into Luna tokens.

A hidden viral loop in the token economics

Things get interesting when the boundaries between merchant/user of the Terra blockchain and validator start to blur. There is no provision in the model to explicitly prohibit merchants from also become holders of Luna and validators in Terra's consensus. In fact, it seems that Terra implicitly optimizes for that. Of course, not all merchants will wear investor hats, but potentially the more savvy (and dare I say the more influential) will recognise that since they are already long the platform as early adopters, they can leverage up on the upside by staking Luna, while reducing their unit costs and hedging the downside, by collecting ledger fees.

Now were that the case, merchant validators are even more incentivized to evangelize Terra; the more merchants on the platform, the more ledger fees they would collect, the more their unit economics would improve and the quicker the platform would get to the critical inflexion point, after which the Luna economics turn positive.

As positive as this might be though, so long as local governments remain skeptical of cryptoassets, it is unlikely that this viral loop will be activated.

Demand for txs = value appreciation for Luna

By now, it should be clear that Terra has been architected in such a way, that makes demand for transactions the critical variable in its value model. So far, the team has implemented 1 stable pair - the Korean Won (KRW), with plans to expand in a multitude of currencies that include the USD and the IMF's SDR.

From a strategic standpoint, the decision to start with the KRW seems smart for a couple of reasons; (i) Korea is one of the most technologically advanced countries globally, with the 2nd highest % of Information and Communication Technology as a proportion of GDP, and 2nd highest % of R&D spend among OECD countries.

Not only does that improve the adoption potential for Terra, but also (ii) given the relatively insular nature of Korean currency markets (see: Kimchi premium), it provides for a "natural" incubator by protecting Terra from external competition. That allows Terra to iterate fast and capture market share in the Korean and ASEAN markets, leveraging local networks, while ironing out the model and improving its potential for further expansion.

Further, the team has explicitly targeted e-commerce as the first market they will be focusing on, a burgeoning industry that has been experiencing anywhere between 5% and 65% CAGR in the region, over recent years. One of Terra’s core strategies is to build an alliance of e-commerce sites and operate as a payment platform for them. The Terra stablecoin may also be offered as an incentive for those making purchases on these sites - a strategy that is serviceable due to the cost efficiency that Terra's blockchain back-end achieves.

In order to bolster their go-to-market capabilities, Terra launched CHAI, a consumer facing e-commerce application for everyday purchases (to illustrate, a large proportion of purchases are reportedly for rice) that works with Terra's blockchain as the back-end payment rails. According to reports from Terra, CHAI has seen 250k sign-ups since launching a few months ago, with $1.3M volume processed.

A quick look at the Terra block explorer points to an approximate equivalent $1.5k as the current daily transaction volume - a figure that pales in comparison to legacy internet native competitors. To illustrate, appox. $200M daily volume processed by Adyen, a Dutch competitor of Stripe that recently underwent an IPO at an $18B valuation. Be that as it may, in the short few months the platform has been live, volume has been growing linearly, showing a healthy - albeit pre-exponential - growth pattern.

While somewhat protected from global markets competitors, Terra faces strong domestic competition from Kakao/Klaytn (who has also a stake in Terra), Toss and other legacy payment solution providers.

Should one be a buyer of Luna at this point?

Terra has secured $32M from Polychain, Arrington XRP and Binance Labs - among others, in a sale that concluded in September 2018. Various ICO listing sites point to the ICO price per Luna token, standing at $0.80. Given the pre-sale patterns we have seen over the years, we could speculate that the price that early investors came in is closer to to $0.2. Anecdotal information we have collected, point to Luna tokens changing hands OTC pre-Mainnet for as much as $2.4 per Luna, which would have put early investors at over a 10x return at that point.

Currrently, the token is trading at $0.43, having listed at approx. $1.7 per token; that's a 75% drawdown, that puts the early investors in the 2x gain region - likely with more realised already, and less of an incentive to sell down on the remainder of their positions.

Arguably, one could pick a worse moment to start building a position, although the lack of liquidity might prove to be an issue, depending on the intended position size.

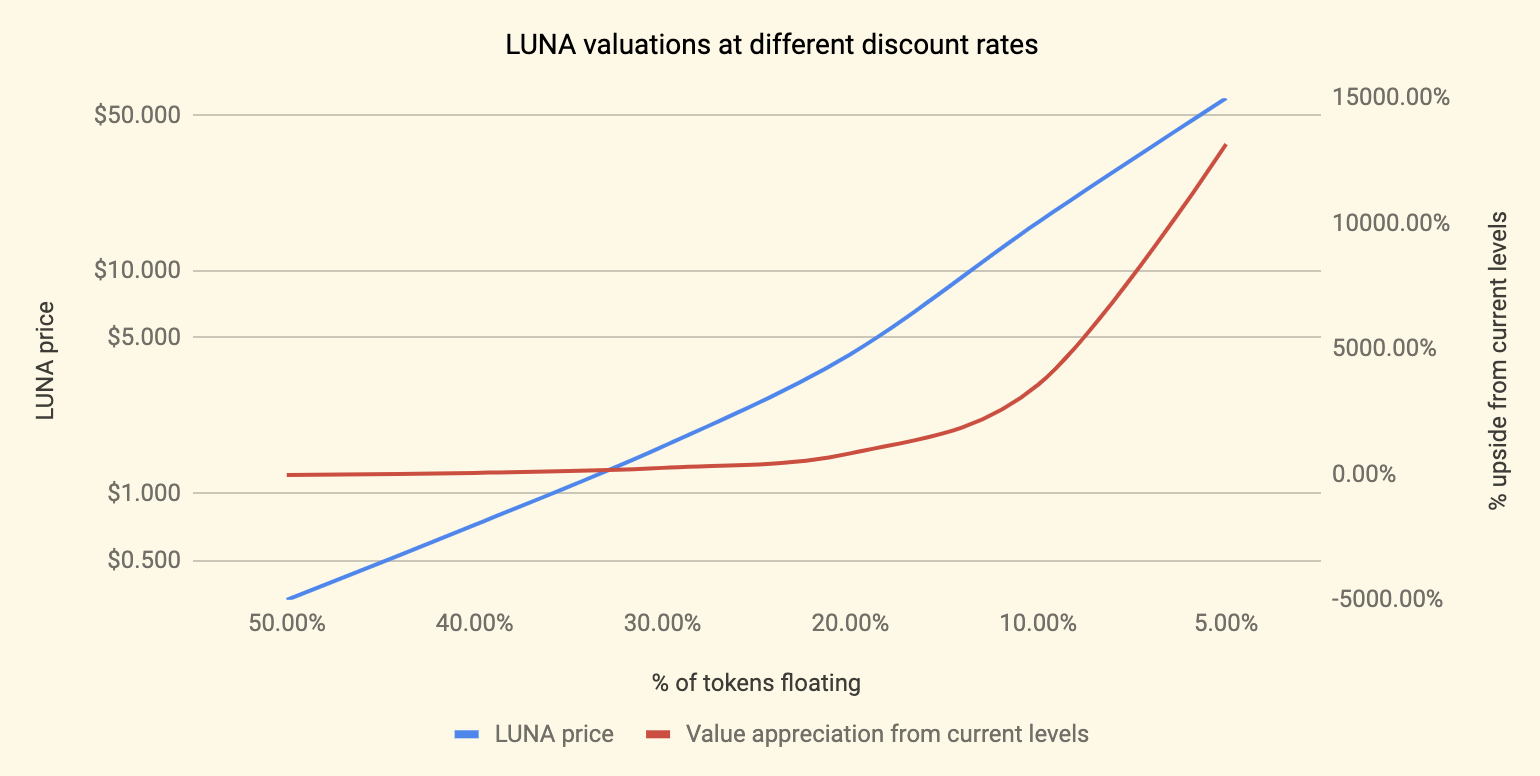

My take on Terra's valuation

To further put some context on current price levels, I went ahead and built a DCF model to value Terra. The premise is that a DCF model applies really well to valuing Luna tokens, as staking Luna is a claim to a stream of future cash flows (tx fees).

Model assumptions

I benchmarked the 3 industries that are most relevant to Terra (shown below), projected their growth in tx volumes according to 3rd party estimates over 10 years, estimated how much share blockchain based solutions are poised to capture over those 10 years (different S-curves) and made an assumption on the proportion of the blockchain quadrant Terra is likely to represent in each industry.

The main assumptions that govern the model beyond the ones mentioned above, are:

a 0.35% tx fee - adjusted downwards from the average {0.1% to 1%} to reflect the cost of running a validator

a 40% discount rate - industry standard for VC

an 80% main use case contribution level - assuming that most of the value transacted on Terra will come from the 3 industries benchmarked

a 25% staking rate - reflecting the current state of Luna staking / total supply

a 2% annual growth rate after the 10 years modelled to capture the terminal value

You can access the model and try your own assumptions here.

The result on the base case scenario, is an estimated $0.72 per Luna, at a $180M network valuation.

What is interesting about the result is that in a scenario building exercise (changing one of the key variables and keeping all else constant), the base case outcome sits a few standard deviations to the left of the mean, implying that at this point there is more upside to owning Luna than downside.

To illustrate, if we assume that 50% of the tx volume on Terra will come from other than the 3 main use cases, then the fair price per Luna token stands at ~$1.3 (3x from current value). If we further relax that assumption to 10%, then the projected upside stands at 10x. Equivalently, while exploring different discount rate levels (reflecting different levels of perceived risk), we find that a 50% discount rate yields a fair price of $0.33 per Luna (a 25% downside), while a 30% rate yields $1.62 per Luna (a 4x outcome) and so on.

What is rotten in the state of Denmark...?

There is a lot that's right about Terra; a great team, a straight-forward token model, a very technology-friendly home market, the potential for explosive growth in the coming years, an attractive current valuation and not many project specific risks. Regarding the latter, there are three main risk drivers that I see here - namely (i) the hidden negative multiplier - covered in an earlier section, (ii) the risk that price oracles introduce in the model, and (iii) the time-lags that exist in the stabilisation model.

As far as (ii) is concerned, this is a problem that underlies the whole blockchain industry and as such I am more inclined to bucket as a systemic type risk. There are currently many solutions being iterated upon, including some higher profile ones from Chainlink and Maker DAO, but also some newer ones like DIA.

Regarding (iii), this is something that I need to spend some more time thinking on. The risk here lies in that the supply side mechanisms that ensure the peg remains stable, will be slow to react to demand side fluctuations - or that the market won't pick them up soon enough. At the scale Terra is at now, the effect should be miniscule.

However, in a condition of large transaction volumes, this could lead to poor price discovery for Terra users and a lot of unintended costs creeping up on merchants' and users' balance sheets.

Parting thoughts

Doing some quick mental accounting on the case presented above, it is fairly clear that the upside here outweighs the downside. The combination of a great market, a great team, an appropriate price point and a novel configuration of blockchain technology in collapsing unit costs, make Terra/Luna an attractive opportunity. If there is ever someone to disrupt Paypal and Stripe, they are likely to look like this in the back-end.

Were one to hold Luna, the incentive is for them to have a long-ish hold horizon, while they would have to be prepared for the potential of further short term value depreciation. However, if there is fundamental belief in the team's ability to execute and the existence of a large enough market for Terra, then the risk is likely a risk worth taking.

And as always - this is a business case exploration and not financial advice. Be safe out there.

A model at odds; reviewing Brave’s token economics

Takeaways

Brave is a standout among crypto projects from the ICO era, when considering the adoption it has managed to drive.

The MAU numbers are still low, when compared to other browser products.

BAT, the native protocol asset, only finds utility as a payment token, which dampens Braves adoptability.

While the adoption numbers are encouraging, more users doesn't necessarily translate into more ad spend, as Brave's core value proposition is ad-blocking.

The ads shown on Brave Rewards are mostly of poor quality and still very crypto specific. Better quality ads and better payouts to users (currently $0.5 pcm) will improve adoption.

Brave is one of the breakout crypto-friendly products to come out of the 2017 ICO boom. The browser is a privacy-first product, offshoot of Mozilla Firefox and fork of Chromium, powered by a cryptoeconomic layer in the back end. Instead of a traditional advertising model, Brave shares 70% of the ad revenue generated, with users, in the form of Basic Attention Tokens (BAT). Whether a user is exposed to ads or not, is up to the their discretion.

Adoption

Recently, the browser surpassed 8M MAU, a YoY growth rate of 166%. While the absolute figures pale compared to Chrome's 3B users, they are certainly outstanding in a crypto context. If the assumption that internet users across the world will increasingly keep becoming privacy sensitive holds true, then a window of opportunity opens up for Brave. On the browser end, Brave is faster than Chrome, while its integration with Duckduckgo on the search engine layer, boosts its privacy preserving value proposition.

Whether or not Brave is an attractive investable opportunity through BAT, largely depends on BAT's token economics. BAT is the native network token that is primarily used as a payment token, in the exchange for attention between advertisers and users. While an ad-blocking browser by default, in Brave users are presented with the option to share their data with advertisers, and see ads in exchange for BAT.

1.5B tokens were issued and distributed over 85% to investors and the wider market - a big long term positive in my book. Until further notice, there will never be any inflation - also a big net positive. BAT tokens have no further intended utility than the payment function described above - a feature I perceive as a net negative.

The numbers of publishers signing up to the Brave ecosystem are steadily increasing. The more publishers there are on the platform, the more attention there is on the platform and thus the more attractive it will be for advertisers to use Brave instead of competing ad networks. In order to do that, advertisers will be required to build up BAT reserves to pay users with.

Over the long term, advertisers would have to engage in some form of reserve management on their BAT holdings, in order to lock down a best price in terms of USD, and optimize their cost basis.

The model is already getting some traction, most of which comes from the crypto-native community. The quality of ads that Brave shows is relatively low, with the majority of the advertised brands being VPN and exchange products. Unsurprising - given the type of user that has become an early Brave adopter, but for the product to become stickier, I feel we would have to see better quality advertising.

Brave token economics from the ground-up

Earlier on, I mentioned that I see BAT's utility as * only * a payment token, as a net negative. The reason why, is that it introduces a lot of overhead for advertisers. There is virtually no reason for merchants to adopt a highly unstable currency equivalent as means of payment in order to reach audiences, except perhaps for if they are long the platform itself - in which case the presumption becomes that every merchant will wear an investor hat. Even then, the case for pure payment tokens is grim as the aforementioned adoption mechanism is a zero-sum game.

If the majority of token economy participants decide to just build up reserves of the native payment token, you would have to assume that their involvement in the Brave ecosystem will not drive the majority of their business, so long as running costs cannot be covered using said token without exchanging it for fiat. In itself, that limits the addressable market.

Now, if the majority of participants decide to not be exposed to volatility and sell down on their token denominated income immediately upon receiving it, then everybody else is incentivised to do so - or be left holding the bag. If we agree that this dynamic is true, then it creates the perfect conditions for a race to the bottom.

The final argument that could work in Brave's favour, would be that the product will be so irresistible and as such attract so many users, that it will be impossible for advertisers to ignore it.

This could be the case for Brave, only it can't, as long as its core value proposition is - quite literally - blocking ads.

I have been using Brave with the Rewards feature on for 3 months now as an experiment and earned 5.9 BAT thus far, which amount to $0.5 pcm at current prices. In western world standards this is inconsequential. Personally, I would rather pay 3x as much to not have to bear with ads.

It’s neither stable, nor volatile - what is it?

For almost 2 years now, BAT's price has ranged between $0.15 and $0.50, and while that makes a good case for relative stability enforced by market forces, it certainly is not as good as a stablecoin's, while it doesn't seem to have the potential for a moonshot either.

Given this PA history, one would expect those advertisers that decide to build BAT reserves to drive up the price to ~$0.5, at which point cyclical sellers would be triggered and they would drive the price down again. Conversely, at prices near the $0.15 level, utility seekers would start buying up reserves again. Without a systematic mechanism to break the cycle, I could see it just endlessly repeating. Good for the speculator that is interested in taking advantage of that cyclicality, but bad for almost everyone else.

A better model would be one predicated on some sort of stablecoin, where BAT would be the protocol asset that would give validators that would stake it access to ledger fess. We are increasingly seeing traction in the work token space, with Terra's dual token model providing for a good example. More on that, in a future post.

Telegram; a sleeping giant awakens

The Telegram Open Network (TON), is the most eagerly anticipated Mainnet launch in 2019 - and not without reason. TON has conjured up the 2nd largest fundraising effort in crypto, second only to that of EOS, and promises to launch a 5th generation blockchain that introduces its native asset, the Gram, as a payments tool to approximately 250 million active users of the Telegram Messenger.

But not all appears to be rosy over at Telegram HQ. The project is late in its roadmap by more than one year, and has only recently released a public Testnet, with all too many variables being currently classified under “unknown”. TON is faced with a dire dilemma; either deliver a working Mainnet by the 31st of October, or return capital to investors.

The small ecosystem around TON is currently seeing a flurry of activity as the deadline approaches fast, with mystery abound as the core developer team continues to keep a very low profile. Will the network launch in time? Will it be sufficiently decentralized? Will it attract the necessary developer interest to populate the network with applications?

In this report, I provide answers to above questions - and many more, in what is possibly the most comprehensive piece of research on all-things TON.

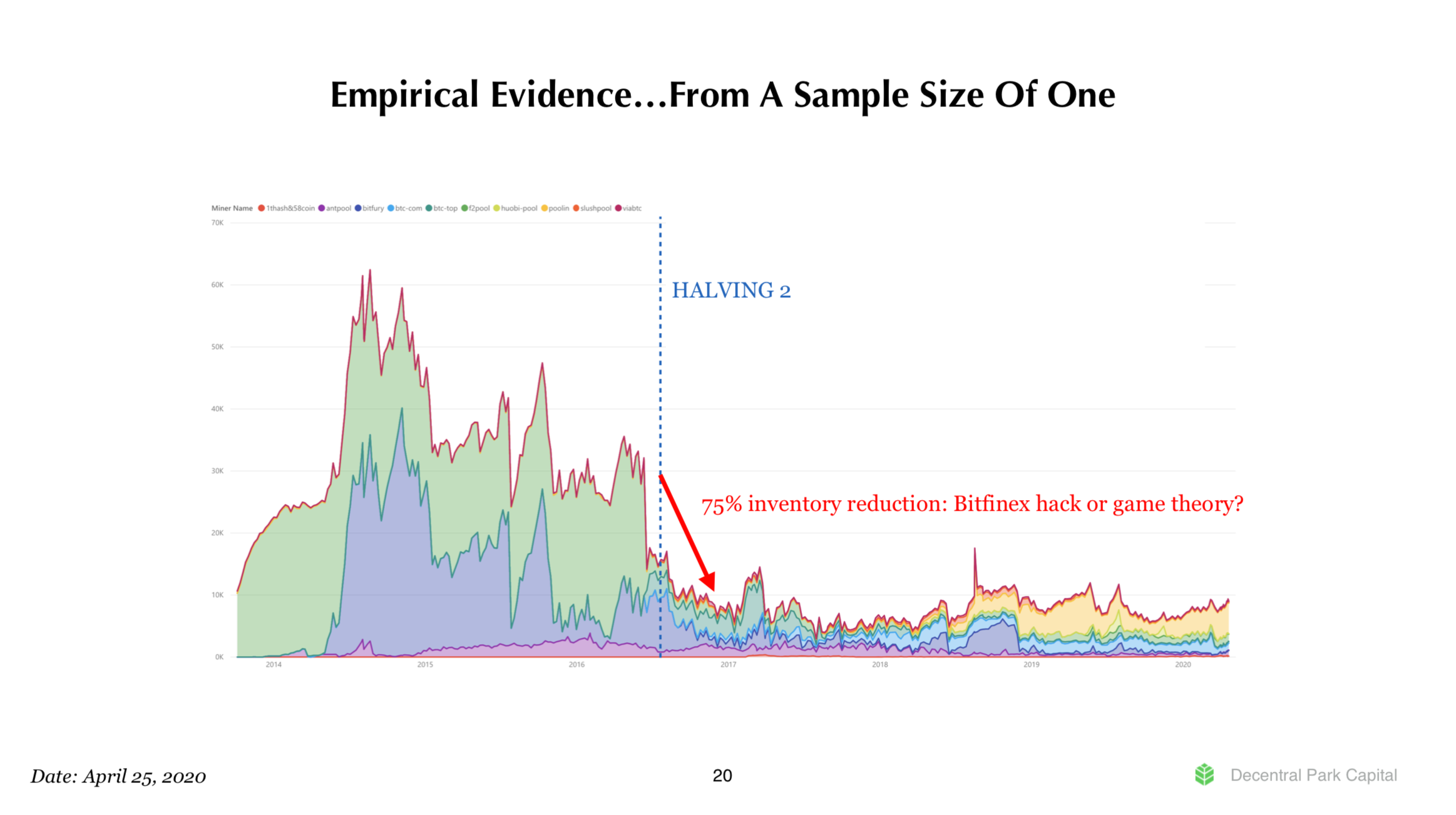

The evolution of the Bitcoin mining landscape

A short twitter thread on the evolution of the mining landscape in Bitcoin. In the short space of 10 years, we have gone from cypherpunks and GPU’s, to pre-IPO behemoths and ASICs. Will it be sovereigns next?

What you see below, is the distribution of miner rewards in $BTC terms, since the first block was mined.

— Elias Simos (@eliasimos) August 1, 2019

If you squint a little, you can discern 3 distinct developmental phases. Let's call them;

1) the hobbyist era

2) the exploration era

3) the professional era

A short thread pic.twitter.com/Hp5i80AIOe

Beyond the hype on xDai

Aka, the DAI of DAI, the native Ethereum stablecoin for fast and cheap P2P transactions, and one of the more hyped projects to come out of the Ethereum developer ecosystem in 2019. By way of xDai recently raising a $500k round led by B-Tech - the investment arm of BitMax.io and Focus Labs - the project came to my attention recently and thought it would make for a good Daily exploration. So without further ado, I'll take some time to present you with the TL;DR on xDai, along with a few quick-fire thoughts on what's good and what's not about the project.

What is xDai?

xDAI is both an Ethereum sidechain, and a token that is pegged to the US Dollar via the DAI, has extremely low transaction fees, and very fast transaction times.

The project was brought to life in a collaboration between POA Network (one of the more active developer teams within Ethereum) and Maker DAO. Users can convert Dai to xDai via POA Network’s TokenBridge, which connects Ethereum and xDai chain.

How does xDai work?

The xDai blockchain is a wholly separate network from the Mainnet that achieves much higher throughput by scaling up the block size and scaling down the block producer (validator) count. The sidechain mechanism is powered by POA's Tokenbridge, and as such requires an own set of validators, separate to those active in Mainnet.

xDai works with 10 validators that are responsible for running nodes and setting the network parameters.

The way xDai is minted works as follows: you lock DAI in a contract on Mainnet, and the validators on the xDai chain mint DAI on the xDai chain to you. Effectively, xDai trades decentralization for performance.

Why xDai and not just DAI?

As a Mainnet token, the DAI is subject to the wild fluctuations that transaction costs on the Ethereum network undergo - tied to a large extent to the availability of resources on the network.

The chart below shows how the history of the median transaction fee on Ethereum, since Q3 2017. Indicatively the median tx fee for 2019 is close to $0.1.

Via the sidechain mechanism (and some sort of transaction batching/key-synching bridge with Mainnet) xDai manages to perform transactions at a steep discount to DAI on the Ethereum Mainnet. More specifically, the cost to perform a transaction on xDai, is about $0.000021.

As we explored above, more recently the same function in Ethereum costs 4000x more (or 0.25% of the transaction value on average), while in the normal financial world, with what it costs to send money in the normal the cost of money transfers is upwards 3% (for international transfers).

Similarly xDai records impressive performance in the transaction speed dimension too. Transactions on the xDAI blockchain occur within five (5) seconds, while a typical Ethereum transaction takes about 1–3 minutes and a normal financial world international transfer, way over 24 hours.

And what about early traction?

Established in October 2018, xDai Chain has attracted the attention of the ecosystem, thanks in no small part to Austin Griffith’s Burner Wallet, which provides a quick and easy way to carry and exchange small amounts of spending-crypto using a mobile browser and serves as a low-friction way to onboard new users.

xDai was used at ETHDenver (Feb 2019) as a platform for the Burner wallet, which allowed thousands of attendees to seamlessly buy food and transfer funds. 11 food trucks accepted xDai via Burner Wallets and sold 4,405 meals for a total of $38,432.56. And the total fees were only $0.20.

xDai was also used during ETH New York, though no similar figures have been made public. Beyond that, there is only one Dapp outside the wallet contingent that uses xDai - and that is the somewhat fringe prediction's market Helena.

Having reviewed what xDai is and how it works - brief as it might have been, let's now consider what xDai has going for it and where it falls short.

In favour of xDai...

- Ultra fast and cheap transactions with stable value. Could really be a game changer for Dapp adoption by providing a significant UX improvement.

- Can see it having significant impact in P2P payments (although one can argue that this is not really a problem in the developed world).

- Supported by two of the strongest developer groups in crypto (MakerDAO and POA).

Against xDai...

- Pegged to DAI, therefore pegged to USD, right? Wrong! The DAI is notorious for breaking its peg with the USD.

- If Ethereum eventually scales via Ethereum 2.0, then xDai is obsolete, as the DAI itself will enjoy similar transaction speed and cost.

- Clunky UX; like with many things in crypto, getting xDai as a user, is far from easy. A user journey would look like this: buy ETH on Coinbase (Pro) with USD, exchange ETH for DAI, transfer the DAI to the Dex Wallet mobile app (dl the app), and exchange DAI for xDAI. Far from ideal.

- Adoption story is over-sold; a quick glance at the types of transactions taking place on the xDAI chain, show virtually 0 P2P usage. Contract call type transactions are disproportionately high, while the most common USD amount transacted comes with 4 to 5 decimals.

- Centralized; 10 validators control the parameters of the ecosystem. This might not matter much as long as xDai is inconsequential, but will certainly matter if/as things progress (e.g. see EOS).

For all its promise, xDai seems to lose out in a tit for tat and leaves the observer with much more to be desired...

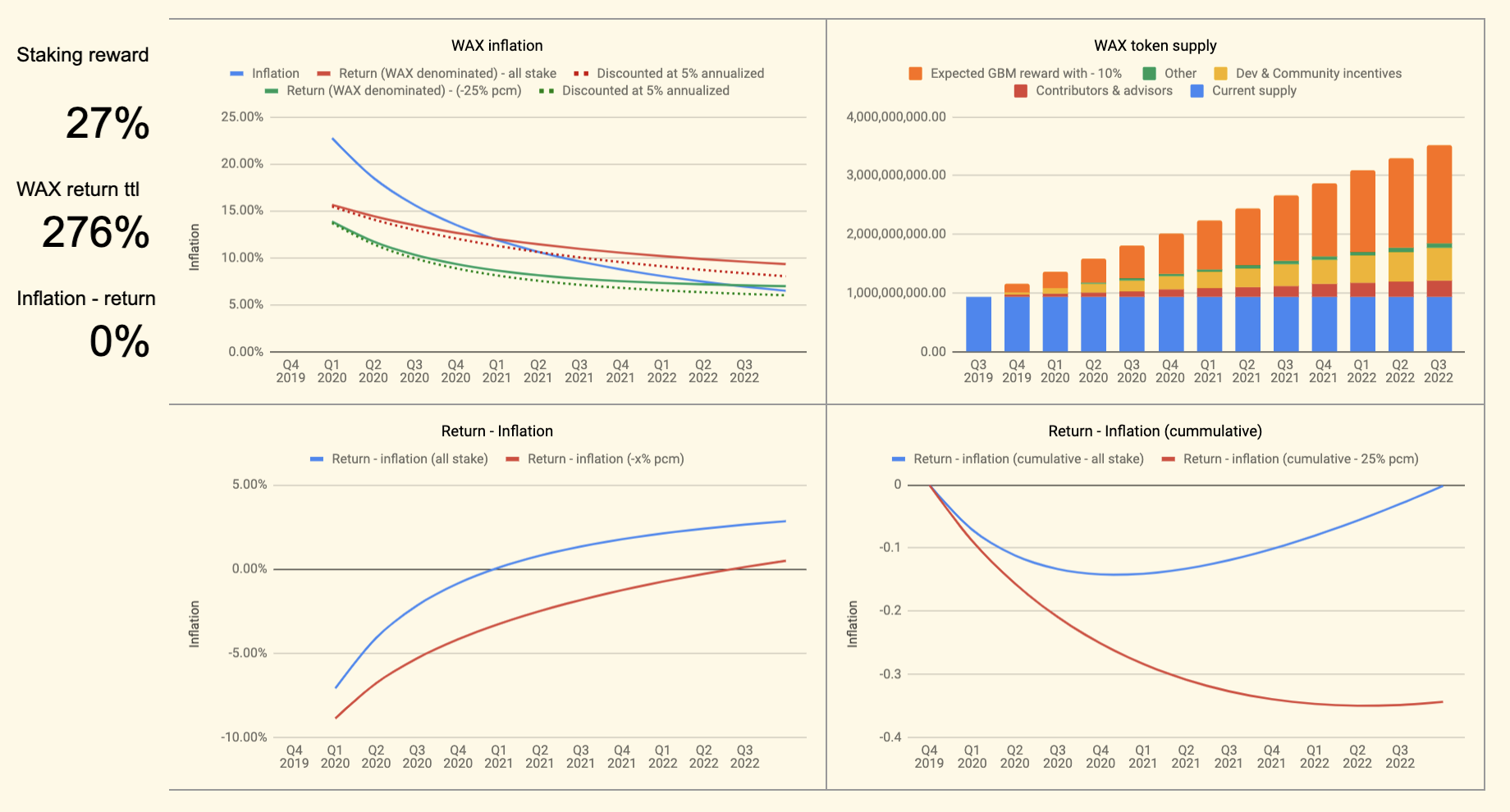

Modelling out the WAX mainnet token economy offering

The present report has been put together drawing from two editions of Decentral Park’s internal daily newsletter, and is presented in format similar to the original (Part 1 & 2). The key findings here are:

WAX will double its notional total supply upon mainnet launch. This is a notional 50% dilution of current holders.

Current holders will have the opportunity to maintain their pro-rata share, only if they remain staked for 3-years - they will receive 1/1092 of their total staked holding every day for those 3 years. Should Genesis Block program (GBM) participants unstake at any point, they lose claim to the remaining residual value stream, and that stream is burned.

Given that the available staking return outside the GBM is roughly 1%, one should consider committing for the whole 3 years of staking, IF and only IF they expect the demand for WAX to increase in excess of the supply of WAX tokens by ~ $130M, over the course of 3 years.

WAX currently owns a large proportion of the total supply. Given that their incentives to remain staked (e.g. lower opportunity cost) are higher than most other parties, they are highly likely to end up with a higher pro-rata share of the network/tokens, at the end of 3-years.

Further, they will initially run 20/21 Block Producers, earning the majority of the inflationary rewards - until they hand over to other interested parties. That further puts WAX in an advantageous position over their token holders - except for if they waive all rewards that accrue from producing blocks.

Please remember that while the model that powered this report is not perfect (e.g. doesn’t make a clear distinction between circulating and non-circulating supply - and probably misses a few more nuances), it is very useful in uncovering different scenaria, and setting benchmarks with respect to the value of the WAX token in the next 3-4 years.

What we know:

- current available supply: 942,732,360 WAX

- total supply: 1,850,000,000 WAX

- total supply will be raised to 3,700,000 WAX by 2022 - a 2x increase

- the additional total supply will be distributed as Genesis Block Rewards (GBM)- a drip function that doubles your holdings in WAX in 3 years (you receive 1/1092 every day), so long as you keep your holdings staked.

- the staking rewards outside that, are speculated to be 1% annualized

If you read between the lines, what WAX is saying is that they will be diluting everybody by 50% over three years, unless they commit to staking all their holdings - and still be subject to some dilution via inflation.

Let's see what modelling with these parameters looks like;

So, should one keep their WAX bonded for 3 years, they should receive 105% their initial WAX back. However, when accounting for inflation, the effective return is -66%, assuming that no new demand hits WAX post Mainnet (edge case).

The curve becomes much steeper when assuming that the staker unbonds 20% of their holdings every month (green line). In other words, the system is designed to keep you locked-in for the whole 3 years.

In order to "break even" under these conditions, one would need a 27% staking yield (annualized) - which is categorically out of the question.

Indicatively, in order to keep the token price at current levels, given the amount of inflation currently planned, WAX would have to 4x its marketcap over three years.

That is add another $180M to its marketcap (1% of the current crypto mcap). However, given that the digital items trading space is projected to be worth somewhere between $20B and $50B, this is not unlikely.

What else we know:

- if you don't participate in GBM upon mainnet launch, you don't get to participate in it ever (happens automatically as you send ERC-20's to burn address).

- as you unstake from the GBM allocation, you cannot re-stake and the remainder of that allocation that would be earmarked for issuance is burned.

What this means is that if we don't see demand for the platform front-run the Mainnet launch to secure allocations for access to the WAX blockchain (which should lead to a nice price bump), every unit of demand that comes to WAX post-Mainnet launch, effectively decreases the inflation rate - as stakers that don't need real estate on WAX (e.g. exchanges or WAX itself), pass their Mainnet tokens on to the incoming demand. As these tokens are unbonded, the earmarked future issuance is burned.

Now, with that in mind, let's have a look at how this plays out, when incorporating these parameters into the model - initially assuming a 10% growth in demand for WAX tokens (as a proxy from demand for real estate on the WAX Mainnet) per quarter.

The growth in all examples that follow, is benchmarked off of $1M initial (new) demand for WAX tokens, starting from Q4 2019.

It seems that with a 10% demand growth, the net improvement is only 4%. Not ideal.

Let's see what happens when you increase the growth projection to 30% per quarter.

Much improved, however, when adjusted for inflation the net return is still negative.

With a little more experimenting, we get to a break-even growth figure of 38.2% per quarter. That translates to approximately $130M of fresh monies hitting the WAX token economy over the course of 3-years.

Beyond that point, things get really interesting. The output for 45% growth per quarter (or ~$200M over the 3 years) points to a 61% inflation adjusted return for the staker. I've also included a positive projection, with the assumption that $2M of new demand hits WAX post Mainnet, with that demand figure growing at 30% per quarter.

The inversion of the "Expected GBM reward" schedule when accounting for demand, should lead to material price appreciation.

Concluding remarks

If the output of the model is correct, then one should consider committing for the whole 3 years of staking, IF and only IF they expect the demand for WAX to increase by ~ $130M over the course of 3 years. Again, considering that the digital items industry is worth $20B to $50B, this is not unlikely at all.

If on the other hand, that kind of confidence in WAX's future performance is not there, then the numbers point to the fact that the potential staker should pack up for greener pastures.

As it stands the holding base of WAX is highly centralized, and so if the thesis about demand seeping through to the platform post Mainnet launch is correct, then things should play out somewhere in the range outlined above.

Part 2

When Part 1 was drafted, the 1% staking reward was taken as anecdotal speculation. Part 2 revisits some of the elements explored in Part 1, accounting for additional information shared by WAX - among which, confirmation that the staking return is likely to range between 0.5% and 1%. Why? Well because staking returns are distributed among stakers (roughly) as follows:

staking return = (tokens staked/total tokens staked) * voting engagement scoreThe voting engagement score ranges between 0 and 1 and to be as close to 1 as possible, you have to be engaged in voting for guilds (delegates) on a weekly basis. As outlined in Part 1, the 1% return is not nearly enough to provide a potential staker with satisfactory enough incentives to stick with it for the long-run. With that variable now known, what the model implies is, in fact, that for the staker to break even, the new demand for WAX token, in excess of current equilibrium, would have to start at approx. $1.15M in Q4 of 2019 and grow at ~40% every quarter from that point onwards.

All things considered though, simple staking is not the only way to earn rewards. If the holder believes that the excess demand condition outlined above and in Part 1is likely to transpire, it would make sense to increase their engagement by either running a Guild (Block Producer), OR at least funding one, so that they ultimately increase the magnitude of the residual return we might be entitled to.

The team recently announced that Hyperchain Capital will be running 1/21 Guilds. The remaining 20 will be run by WAX and a company called StrongBlock.

I find that somewhat concerning. Part 1 concluded that WAX currently owns a large part of the already existing supply of WAX tokens. With them being the residual claimants of the vast majority of the inflationary rewards (at least for the launch and post-genesis periods) only compounds the effect and net-net attributes to WAX being diluted less than all other holders, effectively increasing their share of the token economy.

What is also outstanding in the above statement, is that it implies that the time when WAX decides to relinquish control, is 100% their call (as we gradually roll out), and potentially still a work in progress.

Further, another inconsistency found, was that while WAX quotes the annual inflation figure to be 5%, given that the total supply will double in 3 years after Mainnet launch, the effective inflation rate starts closer to 25%. If this is a perpetuity of 5% added on top of that initial 25%, then the dilution the passive investor would be facing, would be even steeper[1].

Even with the new batch of information on the table, it appears that there is still more pending. More particularly WAX has hinted to "transfer agents" and the "WAX Marketplace" as other ways to earn WAX tokens, more on which will be released in the coming weeks. Within the latest comms from the team, there is also a mention of an additional way to earn WAX tokens at Mainnet launch.

Concluding remarks

If this was the private market, WAX’s strategy would make sense - dilute your earlier investors and ask them to top up on their investment to maintain their percentage of ownership (for those that don’t have any pro-rata clauses at least). In the private markets however, when the time to raise the next round would come (the Genesis Block Program looks very much like a next round for WAX), the valuation of the company would stand at ~2x to 3x the previous rounds. On the contrary, WAX’s current valuation stands at ~1x that of the previous rounds, while token holders have already been diluted by approximately 40%. Consider the following:

June 22nd, 2018:

WAX Mcap: $72M

Token price: $0.113

May 26th, 2019:

WAX Mcap: $72M

Token price: $0.077

That’s a 40% hit on the token price, caused by the new WAX tokens entering circulation. Given all of the above, there is little to point towards the trend reversing here, and the market seems to have caught wind of that. Since the WAX team started drip feeding information about the upcoming Mainnet release, the token price seems to not have responded favourably (yet). One would expect demand to materialize, as investors would rush to secure their Genesis Block Program spots - alas, to no avail, amounting to an affirmation of the concerns raised throughout Parts 1 & 2 of the report.

Blockchain week NY 2019 impressions and takeaways

We're back from an intense, informative and ultimately productive Blockchain week in New York, and I am going to dedicate today's daily in briefly capturing what are some of the learnings I took away from it. Here we go:

Ethereal Summit

The Ethereum community is as strong as ever. There is a certain kind of kool-aid being passed around, which although I personally might find a little disconcerting, I recognize that given that this is a global decentralized community we are talking about, it's a really important glue for the community. There are a few key takeaways from the 2-day conference that I think are worth focusing on; (i) Enterprise is building on Ethereum - Microsoft, VMware, Ernst and Young, are all heavily involved with building PoC's on the Ethereum blockchain - how long until those PoC's become fully fledged products?; (ii) much of the middleware is here - the Ethereum ecosystem is much further ahead than any other blockchain project in providing ample tooling for dapp developers to use; (iii) Gitcoin is becoming a prime distribution platform for middleware, especially for the Ethereum ecosystem - though indirectly.

What is perhaps most striking, however, is that this "flamboyant" gathering took place amidst rumours of Consensys seeking $200M in external funding. In other words,

while many outside the Ethereum community and Consensys seem to believe that they are in trouble, Consensys itself appears strong in its foothold.

Highlight: I paid for Souvlaki with crypto. 2 of my favourite things in the world combined!

Token Summit

This one covered a wide range of current "hot topics" in cryptoland - ranging from regulation to use cases, and from grassroots development and Ethereum community drama to go-to-market for dapps. On the regulation front, the overview is that positive steps are being taken, thought at a pace that is slower than many would prefer. Playing by the rules is expensive (Blockstack apparently spent $2M in funding their Reg A+ offering), and the SEC does not show any willingness to expedite the process of firming up regulations around crypto.

Anecdotally, some of the other most interesting notes I took from Token Summit were that (i) mainstream developers are coming in the next 12 months - Nick Grossman from USV, (ii) STOs are a long process that will likely not yield materially in the next 2-3 years, but in that respect it appears that tokenizing debt is more interesting than tokenizing equity - Josh Stein from Harbor, (iii) marketing seems to almost be a forbidden word among all builders, who seem to be firmly set on "build it and they will come" - an observation echoed by many audience members fairly vocally and defended against by the panelists - industry insiders and that (iv) WASM is a big deal as apart from the huge performance gains, it can compile all popular programming languages AND is maintained by behemoths such as Microsoft and Google. Incidentaly Ethereum 2.0 is swapping the EVM from WASM - though Polkadot will launch first. Finally, speaking of Ethereum, (v) it appears that a lot of the creative funding efforts (e.g. Moloch DAO) the community came up with when ETH was lingering at $100, have been put on hold due to - well - their runway having effectively doubled.

Highlight: Fred Wilson, half jokingly posting up a "bounty" for interested parties to create a DAO that would collect funds to short zombie projects, that hackers affiliated with the DAO would then proceed to attack.

Best of the rest

The rest was a flurry of meetings, run-ins and meetups - perhaps too dense to be granular, so I'll stay on the high level. Many echoed that the energy had shifted from "chasing a quick buck" to "higher quality, long term focus" - indeed, scammy ICOs were nowhere to be found and the mainstays of the scene have shown demonstrable progress. There is a lot to be excited about, with several important Mainnets coming online in 2019.

Also, while the NFT hype train has somewhat ran out of steam, there is real building behind the scenes.

The gaming community is VERY excited about what's coming, but what they are citing is lack of agreed-upon standards that results into a lot of doublework on infrastructure - although a little bit of digging might reveal poor diligence in the available solutions. Interoperability in gaming environments is still something that excites a lot of people, but it appears that it is going to be a grassroots movement first.

A commentary on Burniske's "cryptocommodities vs cryptoassets"

Chris Burniske recently published a blog post titled "Value Capture & Quantification: Cryptocapital vs Cryptocommodities" as an attempt to extending and amending his popularized framework of valuing cryptoassets (MV=PQ) - which you can access directly here. In today's edition I'll provide a summary of the key propositions.

The extension of the thesis, introduces an important distinction of all cryptoassets in two main buckets; cryptocommodities - non-productive digital assets (e.g. Bitcoin) and cryptocapital - productive (stake based) digital assets (e.g. Cosmos ATOMs). The following table provides a conceptual backdrop for the two clusters, borrowed and adapted from Robert Greer's (1997) framework of defining different types of assets.

Burniske asserts that one's best bet in valuing cryptocapital, by merit of its potential for productively generating returns, is a customized DCF, while for non-productive cryptocommodities, the best approach is probably still some rendition of the MV=PQ equation (e.g. NVT, MVRV).

Getting more specific into what constitutes cryptocapital, Burniske offers a loose definition as "any asset that is staked, bonded, or otherwise committed in orderto get a claim on value flows. "Given that within the proposed framework no cryptoasset is of a purely singular nature (CA+CT/A), it is implied that some part of its value might be calculated via a DCF and some other via NVT - though it is further implied that the consumable part might often be negligible, given the supply side insulation that many of these assets are subjected to. What this means is that these assets are used by the supply side to secure the network, and might never be used as demand side instruments.

When considering cryptocommodities, things are presented in a more straightforward fashion - as this strand of thinking has been around for a little longer, and iterations exist since Burniske first proposed the model in 2016. Here's an example of an attempt at valuing cryptocapital from HASH CIB btw, where CUV - current utility value = PQ/V

SoV type assets are presented as an add-on property to cryptocommodities, that according to Burniske make the asset display the unique property of perfect hardness. According to the author, few commodities make the leap into being considered reliable SoVs and for the cryptocommodities that don’t achieve the financial premium associated with SoV assets, their value capture prospects are grim. Here's how this "superclass" is characterised in the whitepaper;

A couple more interesting assertions being made in the paper are that:

commodities are typically thought of as having a floor at their marginal cost of production - and Bitcoin seems to so far exhibit similar behaviour (miner's PnL).

in a digital world, there is no natural consumption/destruction of the commodity - which is where the artificial constriction of supply through forced burning and extreme scarcity becomes vital (bye bye GRIN).

most physical commodities have marginal costs of production that fall as the systems cales in its ability to extract it - in crypto it's the opposite.

assets that have to be somehow put to work to earn residual income, are distinctly different than assets on which passive income is earned, and therefore are more difficult to define as securities.

But perhaps the most valuable takeaway of all is the following:

It is becoming increasingly clear that for a token economy to attract value, there has to be some form of stake and/or work involved - the clearer the implication, in fact, the better - as the closer we get to repeatable business/network models, the closer we get to the promised land.